All Categories

Featured

Table of Contents

For many people, the greatest trouble with the limitless banking concept is that initial hit to early liquidity triggered by the costs. This con of unlimited banking can be reduced considerably with correct plan layout, the first years will certainly constantly be the worst years with any Whole Life policy.

That claimed, there are particular unlimited banking life insurance policy policies developed mostly for high early cash value (HECV) of over 90% in the initial year. The long-term efficiency will certainly commonly considerably delay the best-performing Infinite Banking life insurance coverage plans. Having access to that extra 4 figures in the very first few years may come with the cost of 6-figures later on.

You in fact get some significant lasting advantages that help you recoup these early expenses and after that some. We find that this prevented very early liquidity problem with limitless banking is more psychological than anything else as soon as extensively discovered. Actually, if they definitely required every penny of the cash missing from their unlimited financial life insurance plan in the very first few years.

Tag: boundless banking principle In this episode, I talk about financial resources with Mary Jo Irmen who instructs the Infinite Financial Idea. This topic might be questionable, but I intend to get varied views on the show and learn more about various strategies for ranch financial administration. A few of you might concur and others will not, but Mary Jo brings an actually... With the rise of TikTok as an information-sharing system, financial suggestions and strategies have actually located a novel means of dispersing. One such technique that has actually been making the rounds is the boundless banking idea, or IBC for short, gathering endorsements from celebs like rapper Waka Flocka Fire. However, while the method is currently prominent, its origins trace back to the 1980s when financial expert Nelson Nash introduced it to the world.

Within these plans, the money worth grows based upon a rate set by the insurance firm. Once a substantial cash value builds up, insurance holders can obtain a cash money worth car loan. These finances vary from traditional ones, with life insurance policy offering as collateral, suggesting one could lose their protection if loaning excessively without adequate money worth to sustain the insurance coverage prices.

And while the appeal of these plans is noticeable, there are natural constraints and threats, requiring persistent cash worth monitoring. The approach's legitimacy isn't black and white. For high-net-worth people or company owner, particularly those using approaches like company-owned life insurance policy (COLI), the advantages of tax obligation breaks and substance growth might be appealing.

Infinite Banking Forum

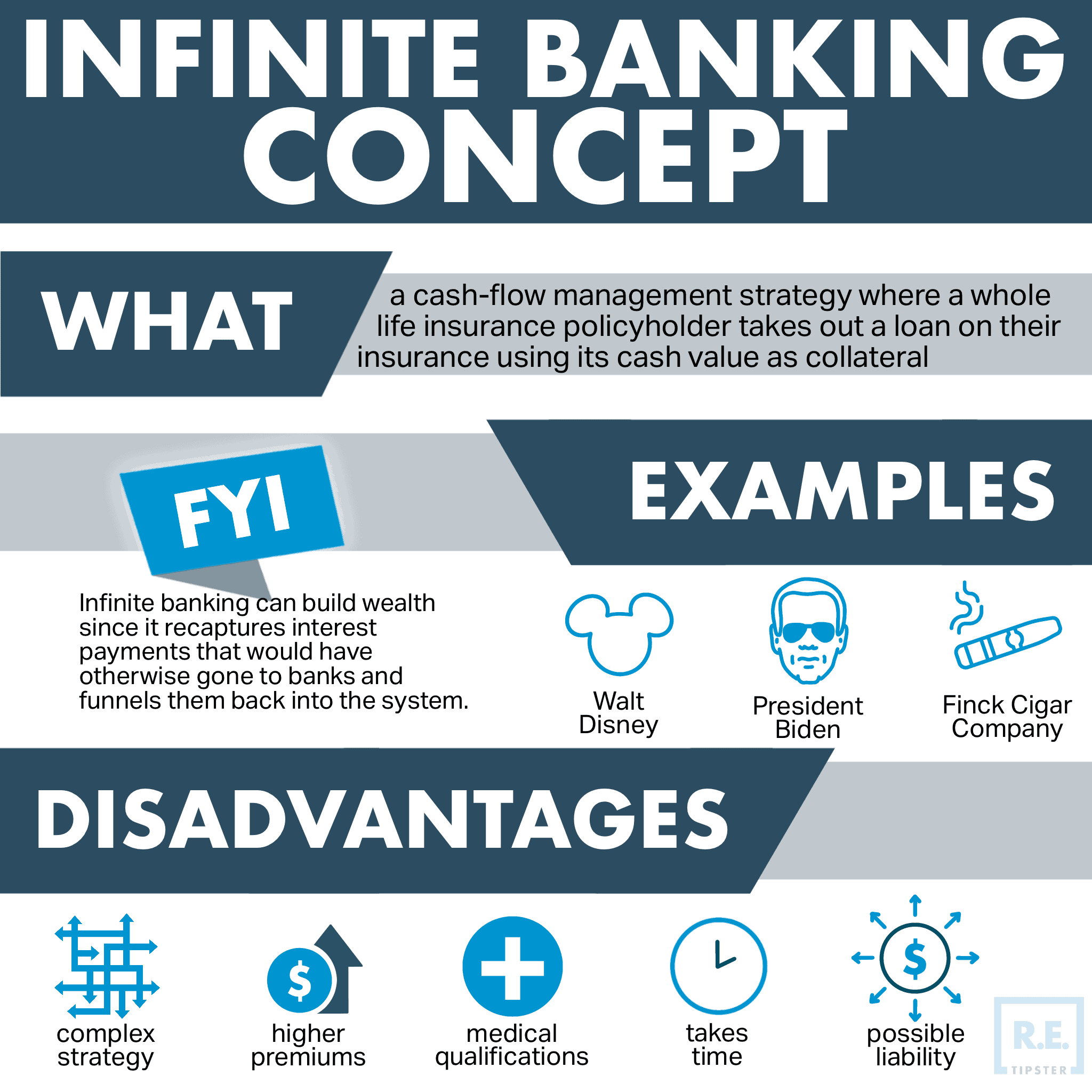

The allure of boundless banking does not negate its difficulties: Expense: The foundational requirement, a permanent life insurance policy policy, is more expensive than its term counterparts. Eligibility: Not every person receives entire life insurance coverage due to strenuous underwriting procedures that can exclude those with details health or way of living problems. Intricacy and risk: The elaborate nature of IBC, coupled with its risks, may hinder numerous, especially when less complex and less dangerous choices are available.

Designating around 10% of your regular monthly income to the policy is just not viable for the majority of individuals. Component of what you read below is merely a reiteration of what has actually currently been claimed over.

So prior to you get on your own right into a scenario you're not gotten ready for, know the following first: Although the concept is typically marketed thus, you're not actually taking a financing from yourself. If that held true, you wouldn't need to settle it. Rather, you're obtaining from the insurance coverage company and need to settle it with passion.

Some social media messages recommend utilizing money value from entire life insurance coverage to pay down credit history card debt. When you pay back the funding, a section of that rate of interest goes to the insurance firm.

For the initial numerous years, you'll be paying off the commission. This makes it exceptionally difficult for your policy to collect worth throughout this time. Unless you can manage to pay a couple of to numerous hundred dollars for the next decade or even more, IBC won't work for you.

What Is Infinite Banking Life Insurance

Not everyone needs to count only on themselves for economic safety and security. If you require life insurance policy, right here are some important tips to consider: Consider term life insurance policy. These plans offer insurance coverage during years with considerable economic obligations, like home mortgages, trainee fundings, or when caring for young kids. Ensure to go shopping about for the very best price.

Copyright (c) 2023, Intercom, Inc. () with Reserved Typeface Call "Montserrat". This Font style Software is certified under the SIL Open Up Typeface License, Version 1.1. Copyright (c) 2023, Intercom, Inc. (legal@intercom.io) with Reserved Typeface Call "Montserrat". This Font style Software application is licensed under the SIL Open Up Font Style Certificate, Variation 1.1.Skip to main web content

Life Insurance Through Banks

As a certified public accountant focusing on property investing, I've brushed shoulders with the "Infinite Banking Principle" (IBC) extra times than I can count. I've also talked to specialists on the subject. The primary draw, other than the obvious life insurance policy advantages, was constantly the idea of accumulating cash money worth within a permanent life insurance coverage policy and borrowing against it.

Certain, that makes good sense. But truthfully, I always thought that money would be much better spent straight on financial investments as opposed to channeling it with a life insurance policy plan Till I discovered exactly how IBC might be combined with an Irrevocable Life Insurance Policy Trust (ILIT) to produce generational wide range. Let's start with the fundamentals.

What Is Infinite Banking Concept

When you borrow versus your plan's cash value, there's no collection settlement timetable, giving you the liberty to take care of the finance on your terms. Meanwhile, the cash money worth continues to expand based upon the policy's warranties and returns. This arrangement permits you to access liquidity without disrupting the lasting development of your plan, gave that the loan and rate of interest are handled sensibly.

The procedure continues with future generations. As grandchildren are birthed and grow up, the ILIT can buy life insurance policy plans on their lives. The trust fund after that collects numerous policies, each with expanding money worths and death advantages. With these policies in position, the ILIT effectively ends up being a "Family members Bank." Relative can take loans from the ILIT, using the money worth of the policies to fund investments, start companies, or cover major costs.

An essential facet of handling this Family Financial institution is the use of the HEMS criterion, which means "Health and wellness, Education, Maintenance, or Support." This standard is commonly included in trust fund arrangements to route the trustee on exactly how they can disperse funds to recipients. By adhering to the HEMS standard, the trust fund makes certain that distributions are made for necessary needs and long-term assistance, protecting the count on's properties while still attending to relative.

Raised Flexibility: Unlike stiff financial institution loans, you regulate the repayment terms when obtaining from your very own policy. This permits you to structure repayments in such a way that lines up with your organization capital. infinite banking nelson nash. Enhanced Cash Flow: By financing overhead with policy loans, you can possibly release up money that would certainly or else be locked up in standard financing settlements or equipment leases

He has the same tools, but has additionally constructed extra cash money worth in his plan and got tax obligation advantages. And also, he now has $50,000 offered in his policy to make use of for future possibilities or expenses., it's important to view it as more than just life insurance.

Cash Flow Banking Insurance

It's regarding producing an adaptable funding system that offers you control and supplies multiple benefits. When made use of strategically, it can enhance various other financial investments and company methods. If you're intrigued by the capacity of the Infinite Financial Idea for your company, below are some actions to consider: Educate Yourself: Dive much deeper right into the principle via credible publications, workshops, or examinations with knowledgeable experts.

Latest Posts

Infinite Banking Agents

Becoming Your Own Bank

Infinite Banking Example